Across a variety of different insurance sectors, from property and casualty to health and auto insurance, managing the complexity of regulations is a shared challenge. Insurance professionals are always dealing with obstacles and roadblocks in the form of managing and communicating compliance and regulation standards to current and new customers.

With a complex suite of products, each with a variety of share classes, it can take months for a marketing department to update and distribute new communications and marketing collateral with quarterly regulatory changes. In companies with thousands of representatives across the nation or globe, slow speed to market and inaccurate, outdated communications are inevitable—causing longer, less effective sales cycles and market confusion.

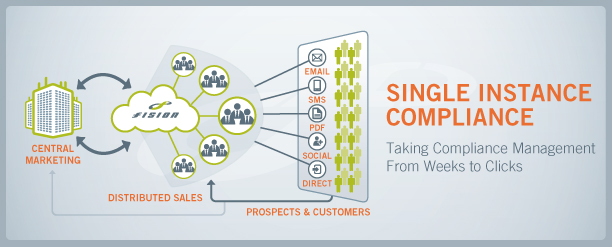

Fortunately, software has been the boon of this complex sector for the better part of a decade. The right solutions can make compliance management significantly easier, helping to stay in line with regulatory standards and quicken speed to market. Fision is one solution that has gained popularity among the insurance industry. Fision eases pressure on marketing and compliance by allowing them to make company wide compliance changes and distribute them with a few clicks.

Save Time and Remain Compliant… Get Organized

The effort to simplify compliance management starts with ensuring their sales and marketing initiatives remain organized. Fision’s Marketing Asset Management platform (MAM) allows firms to establish libraries of ready-to-use content from one central repository. Giving sales a single place to go to find current sales materials avoids wasted time searching for, or even worse, creating their own materials and prevents the use of non-compliant product offerings.

Simplify Sales By Speaking Directly to Customer Needs

A complex product offering can be difficult to communicate to new customers and prospects. An Astonish Results survey found that six out of 10 insurance buyers are using the internet to research companies, and if firms want to successfully engage and convert these individuals, they need their marketing campaigns to be spot on. Fision allows marketers to create customizable templates with brand and legally compliant images, messages and product offerings so that insurers can easily customize sales collateral with product offerings that speak directly to their customers’ needs.

Visibility Provides More Meaningful Data and Takes the Terror out of Audits

Insurance marketers know that data is king and tracking materials for audits is a nightmare. Fision’s reporting and analytics gives marketers/sales managers visibility over how the assets and communications are being used and how well they are being received. Having real-time results and data helps insurers make the necessary adjustments to improve return on investment (ROI).

Fision also takes a lot of pain out of those looming compliance audits. Even departments that keep solid track of their files could spend 3-4 weeks prepping for a compliance audit. Fision’s Marketing Asset Management platform not only keeps all the updated materials in one central repository, it also tracks its usage company wide. This functionality can shorten this ugly process from weeks to days.

Single Instance Compliance = ROI

Using Fison to control each and every piece of compliance in one instance gives your marketing team the ability to change materials, company wide, in a few clicks. What used to take weeks can now be done in minutes. Combining those internal efficiencies and empowering your sales force with accurate, customizable materials creates an increase in speed to market and customer relevance. In a sales driven environment, this has a huge impact on ROI.